EDUCATING & EMPOWERING DIVORCING HOMEOWNERS MAKE WELL INFORMED DECISIONS

JACQUELINE CRIDER NMLS #943284

DIVORCE LENDING MORTGAGE PROFESSIONAL

WELCOME TO A FRESH START

"A house is built with walls and beams; a home is built with love and dreams." - Ralph Waldo Emerson

GAIN EXPERT INSIGHT...

WITH COMPASSION AND UNDERSTANDING

With over twenty years of experience in the mortgage industry, Jacqueline Crider is a trusted professional who assists individuals going through divorce. Jacqueline and her team specialize in educating, empathizing, and empowering their clients on mortgage, real estate, and credit matters, especially pertaining to divorce. Jacqueline's expertise extends to offering complimentary divorce planning consultations and supporting family law attorneys and financial advisors in navigating the crucial area of the marital residence.

Hey, I'm Jacqueline!

"Having experienced a divorce first hand, I know how incredibly frustrating and overwhelming the process can seem. So often people don’t think about speaking to a mortgage professional until after the divorce is done and that’s just so wrong!

Getting the mortgage professional involved early in the process can be the difference in moving on quickly vs. having the complications stretch out well beyond the finalization of the divorce.

What exactly do I mean? Here in Texas we have some weird home equity laws which can create some unique challenges when a divorce is involved and one party has to pay the other party their portion of the equity. Unfortunately all too often, the way the language appears on the divorce decree doesn’t properly clarify the situation, making it much more difficult to finalize getting a refinance accomplished.

My goal is to simplify this process, educate all parties, help a smooth refinance process, or even a purchase of a new home. Whatever can help settle down your home situation faster! That’s what I want.

Having a law degree myself makes me an invaluable asset as I will be able to easily communicate with your attorney to unsure all the professionals are working together to take the stress and pressure off you! I’d love the opportunity to talk to you about your options."

-Jacqueline Crider, Mortgage Professional and Divorcing Lending Expert

EXPLORE YOUR OPTIONS WITH CONFIDENCE:

Book a Free Consultation Today

Meet Our Team

Frequently Asked Questions

DISCUSS WITH JACQUELINE

EXPLORE YOUR OPTIONS WITH CONFIDENCE:

Book a FREE Consultation Today!

WELCOME TO A FRESH START

The marital home is typically incredibly important for most couples, and represents their most valuable asset. It becomes one of, if not the most important thing in the divorce settlement.

For some people, the home is where their children are growing up, emphasizing the need to do their best to maintain stability and consistency. Others though, find it an incredibly painful reminder of the relationship's end.

Whether it's a sentimental attachment to your home, it's conveniently located near your job, or in an excellent school district for your kids, numerous emotional, financial, and practical considerations come into play.

JACQUELINE CRIDER is here to guide you through exploring your options regarding the your current home and determining your future residence following the finalization of your divorce.

KEEPING YOUR HOME?

There are 5 key considerations if you plan to keep your home after the divorce is final. One of the biggest is

NEED CREDIT HELP?

Often, Financial problems are a factor in the breakdown of a marriage. These difficulties can lead to…

LEAVING YOUR HOME?

Whether you decide to sell your home or your spouse will retain it, when it’s all said and done, where will you live?

WHY USE JACQUELINE?

Choosing the right mortgage provider is a very important decision. Especially in a divorce situation.

What others are saying about us

Christine P., Client

"I appreciate Jacqueline's work this past year. She was great throughout, an invaluable asset, always prepared, and made my quick closing smooth with zero surprises. She ensured care for my ex too with such kindness, which is a challenge. I will pass Jacqueline's name on to anyone needing her services."

Rusty S., Client

"I'm not great with words, but I want to share my experience with Jacqueline. Divorce is never fun and has its fair share of challenges, but Jacqueline answered all my questions, always responded quickly, completed everything timely, and helped me afterwards. I truly appreciated her so much during such a difficult time in my life."

Keith S., Client

"After wasting time with two other mortgage lenders who clearly didn't understand divorce, I was referred to Jacqueline and her team. She not only understood what she was doing, she and her team were so patient with me. Taking time to explain the process, never getting frustrated, and working through my lack of home buying knowledge. This was so refreshing after my prior two experiences!"

Get In Touch

Email: [email protected]

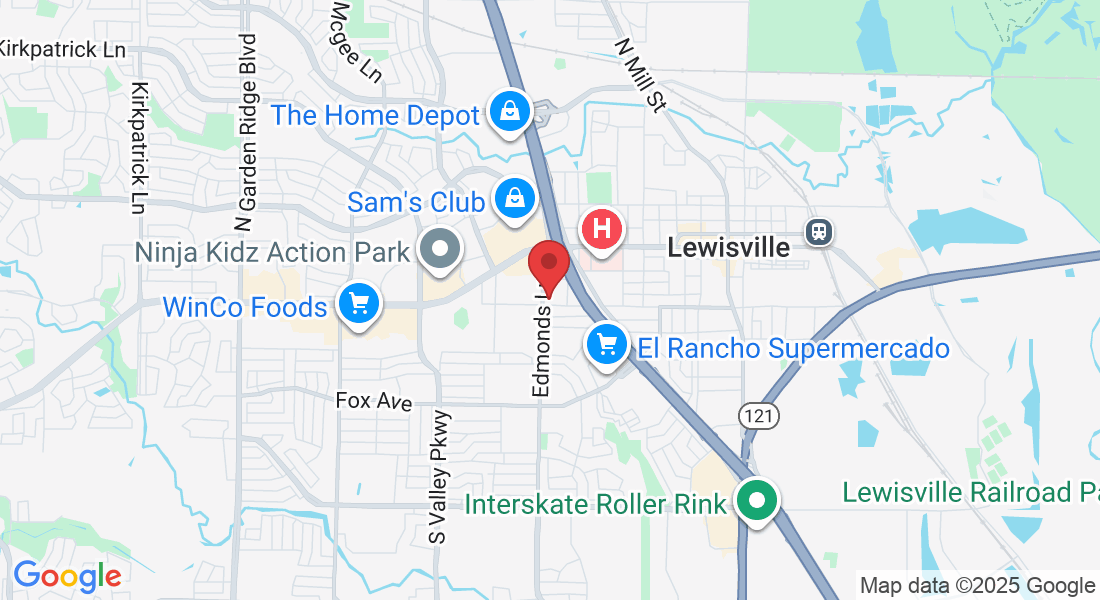

Address

Office:

550 Edmonds Ln #102

Lewisville, TX 75067

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

469-373-3107

Start Fresh.

WE'RE HERE TO ASSIST - REACH OUT FOR A COMPLIMENTARY CONSULTATION.

PBJ Mortgage NMLS # 2408499